south san francisco sales tax rate 2021

South San Francisco in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in South San Francisco totaling 175. Click here to find.

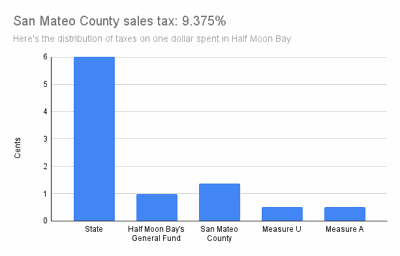

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

The California sales tax rate is currently 6.

. Tax rates are provided by Avalara and updated monthly. Whether you are already a resident or just considering moving to South San Francisco to live or invest in real estate estimate local property tax rates and learn how real estate tax works. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Webpage and select. San Francisco County collects on average 055 of a propertys assessed fair market value as property tax. South san francisco ca sales tax rate.

The California sales tax rate is currently 6. You can find more tax rates and allowances for South San Francisco and. It was raised 0125 from 975 to 9875 in July 2021.

Look up 2021 sales tax rates for San Francisco Colorado and surrounding areas. The average sales tax rate in California is 8551. Method to calculate South San Gabriel sales tax in 2021.

4 rows The 85 sales tax rate in San Francisco consists of 6 California state sales tax. Method to calculate South San Francisco sales tax in 2021. South san francisco Tax jurisdiction breakdown for 2022.

Learn all about South San Francisco real estate tax. South San Francisco 05. The 94112 San Francisco California general sales tax rate is 85.

By appointment only please contact us by phone or email for scheduling. San Mateo County District Tax Sp 213. State sales tax rates.

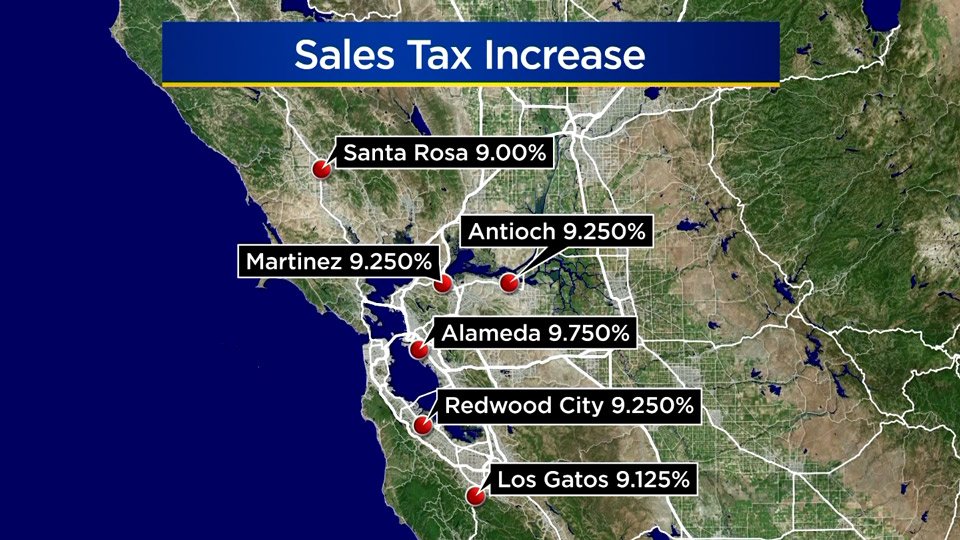

The new rates will be displayed on July 1 2021. California City County Sales Use Tax Rates. 1788 rows California City County Sales Use Tax Rates effective January 1 2022.

4 rows The current total local sales tax rate in South San Francisco CA is 9875. Tax Rate and then select the Sales and Use Tax Rates. The current Conference Center Tax is 250 per room night.

The South San Francisco California sales tax is 750 the same as the California state sales tax. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 1 day agoSAN FRANCISCO KRON Several Bay. Method to calculate South San Francisco sales tax in 2021.

Those district tax rates range from 010 to 100What is the sales tax in California 20217252021 Local Sales Tax RatesA Presidio San Francisco Sales Tax Calculator For 2021 December 28 2021 at 430 am. This is the total of state county and city sales tax rates. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

The average sales tax rate in California is 8551. This is the total of state county and city sales tax rates. The South San Francisco sales tax has been changed within the last year.

The minimum combined 2021 sales tax rate for south san francisco california is. South San Francisco California Sales Tax Rate 2021 The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

You may also call our Customer Service Center at 1. South San Francisco Resident Survey Shows Residents Feel City is Moving in Right Direction. Depending on the zipcode the sales tax rate of south san francisco may vary from 65 to 975.

The San Francisco Tourism Improvement District sales tax has been changed within the last year. The current Transient Occupancy Tax rate is 14. You can print a 9875 sales tax table here.

The san francisco sales tax rate is 0. How much is sales tax in San Francisco. California Prop 15 Results Proposition Fails Leaving 1978s Prop 13 Untouched Not Raising Property Taxes Abc7 San Francisco 1000000 or more but less than 5000000 375.

The South San Francisco California sales tax is 750 the same as the California state sales tax. The County sales tax rate is 025. The average sales tax rate in California is 8551.

The minimum combined sales tax rate for San Francisco California is 85. South san francisco. Apr 01 2021 The current total local sales tax rate in South San Francisco CA is 9750.

South San Francisco California Sales Tax Rate 2021 - Avalara The minimum combined 2021 sales tax rate for South San Francisco California is 988. This is the total of state county and city sales tax rates. Boost your business with wix.

Tax returns are required monthly for all hotels and motels operating in the city. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. CHICO The city of Chico is proposing a ballot measure set for the November 2022 election that would raise the local sales tax by.

Find a Sales and Use Tax Rate by Address. The December 2020 total local sales tax rate was 8500. From there go to the.

San Mateo Co Local Tax Sl 1. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021. The minimum combined 2021 sales tax rate for south san francisco california is.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Frequently Asked Questions City Of Redwood City

Sales Tax On Grocery Items Taxjar

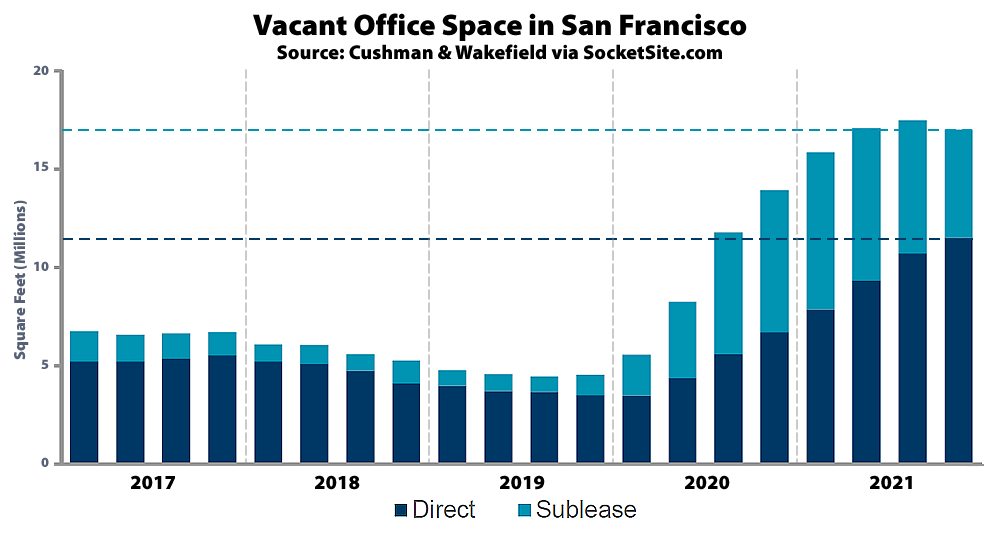

Office Vacancy Rate In San Francisco Inches Down But

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco

California Sales Tax Small Business Guide Truic

Finance Department City Of South San Francisco

California City County Sales Use Tax Rates

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

How Do State And Local Sales Taxes Work Tax Policy Center

How High Are Capital Gains Taxes In Your State Tax Foundation

Why Households Need 300 000 To Live A Middle Class Lifestyle

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Sales Tax On Saas A Checklist State By State Guide For Startups

California Sales Tax Rates By City County 2022